Issue #2: New York City Taxes More Valuable Property at Lower Rates than Less Valuable Properties

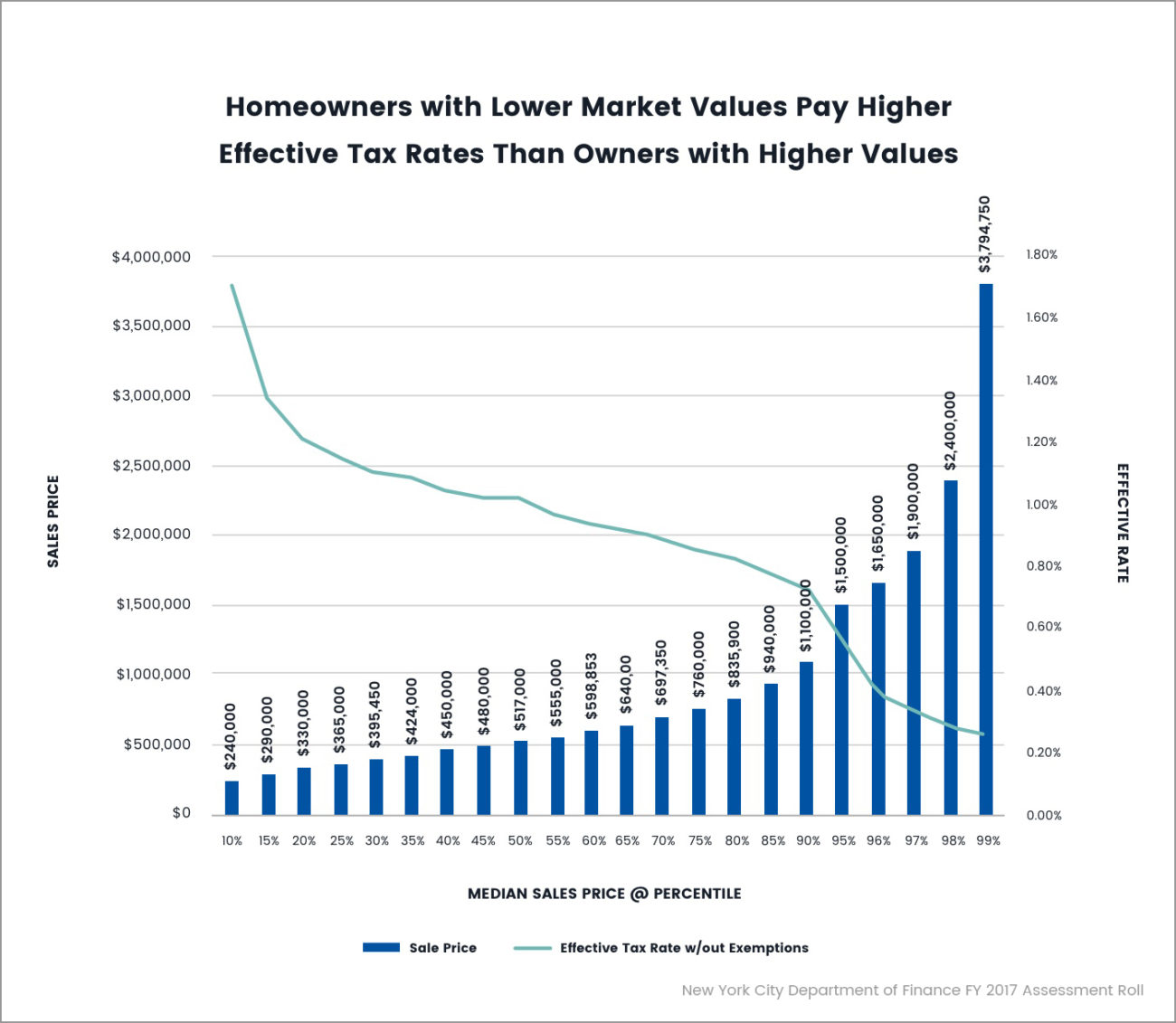

Figure 2.1: Houses with median sales prices in the lowest percentile pay higher effective tax rates (taxes divided by sales price). Houses with median sales prices in the 10th percentile, or priced at $240,000, paid an effective tax rate of almost 1.8%. Homeowners with median sales prices in the 99th percentile, or priced at almost $3.8 million paid, an effective tax rate of a little more than .20% (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.2: Cooperative apartments with lower median sales prices pay higher effective tax rates. Apartments that sold for $145,000 paid an effective tax rate of almost 2.6%. Whereas apartments that sold at prices in the top 1%, or priced at more than $6 million, paid an effective tax rate of about .55%, which is 78% less (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.2: Cooperative apartments with lower median sales prices pay higher effective tax rates. Apartments that sold for $145,000 paid an effective tax rate of almost 2.6%. Whereas apartments that sold at prices in the top 1%, or priced at more than $6 million, paid an effective tax rate of about .55%, which is 78% less (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.3: Condos with lower median sales prices pay higher effective tax rates. Condominiums that sold for the lowest prices at the 10th percentile, or at $355,000, paid an effective tax rate of almost 1.4%. The highest-valued condominiums that sold for almost $12 million paid an effective tax rate of just a little more than .4% (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.3: Condos with lower median sales prices pay higher effective tax rates. Condominiums that sold for the lowest prices at the 10th percentile, or at $355,000, paid an effective tax rate of almost 1.4%. The highest-valued condominiums that sold for almost $12 million paid an effective tax rate of just a little more than .4% (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.4: Commercial properties with lower median sales prices pay higher effective tax rates. Condominiums sold for the lowest prices at the 25th percentile, or $182 per square foot, paid an effective tax rate of almost 3.25%. The highest-valued commercial properties, which sold for $3,166 per square foot, paid an effective tax rate of 1% (New York City Department of Finance FY 2017 Assessment Roll).

Figure 2.4: Commercial properties with lower median sales prices pay higher effective tax rates. Condominiums sold for the lowest prices at the 25th percentile, or $182 per square foot, paid an effective tax rate of almost 3.25%. The highest-valued commercial properties, which sold for $3,166 per square foot, paid an effective tax rate of 1% (New York City Department of Finance FY 2017 Assessment Roll).

Understanding the Implications of a Regressive Property Tax System

The New York City property tax system is inherently regressive and charges a higher effective tax rate for lower valued properties than those that are higher valued.

This unfair system disproportionately burdens middle- and low-income New Yorkers by inflating the overall cost of homeownership across property types for cheaper homes for the benefit of those that are more expensive. This results in homeownership becoming even more unaffordable for the majority of New Yorkers with limited means.

The benefits of homeownership are substantial both for individuals and economies at large. Owning property may enable New Yorkers to investment in education and businesses, provide economic security in times of lost jobs or poor health, and pass on advantages to children (Is Homeownership Still an Effective Means of Building Wealth for Low-income and Minority Households? (Was it Ever?), Harvard University Joint Center for Housing Studies, 2013).

Instead of making homeownership more unattainable, policymakers should enact an equitable tax structure that enhances the quality of life and economic opportunities for the majority of New Yorkers.

Learn how the rent crisis disproportionately affects NYC Renters.