Issue #5: New York City’s Most Expensive Homes are Undervalued and Pay Lower Taxes Than Most NYC Properties

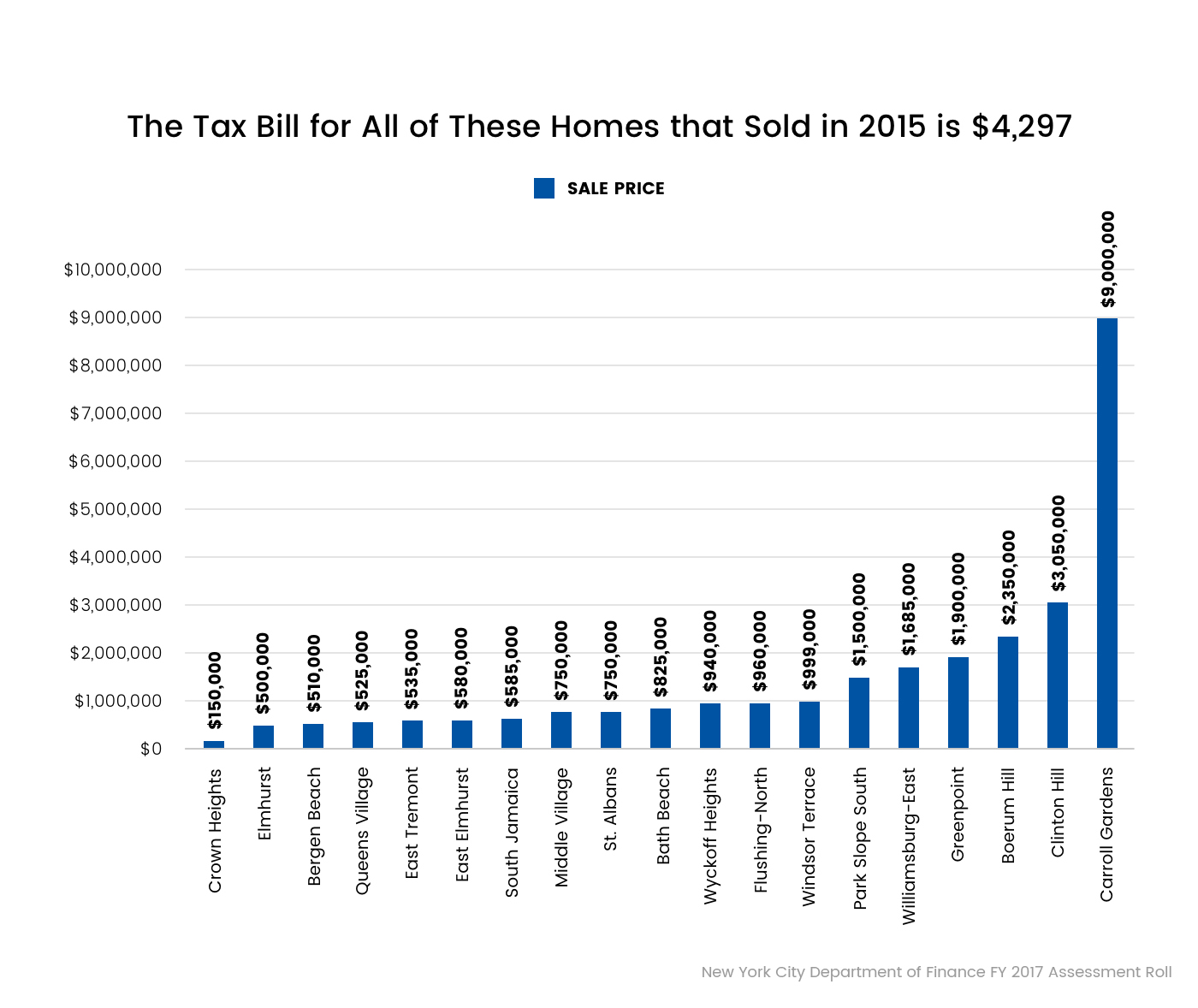

Figure 5.1: Despite radically different sales prices, each of the properties pay the same tax assessment (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.2: Despite the same sales price, each of the properties pay a radically different amount in taxes (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.3: New York’s tax system greatly under assesses the city’s most expensive condominiums. (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.3: New York’s tax system greatly under assesses the city’s most expensive condominiums. (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.4: New York’s tax system greatly under assesses the city’s most expensive cooperatives (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.4: New York’s tax system greatly under assesses the city’s most expensive cooperatives (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.5: Each property class contributes an uneven burden in comparison to the market share (New York City Department of Finance FY 2017 Assessment Roll).

Figure 5.5: Each property class contributes an uneven burden in comparison to the market share (New York City Department of Finance FY 2017 Assessment Roll).

Understanding the Consequences of an Unequal Property Tax System

New York City property is valued and taxed pursuant to a muddle of assessment caps, legislative rules, and politically-driven choices by city leaders. In addition, the city’s property tax scheme makes no attempt, rationally and neutrally, to determine actual fair market value and impose a fair tax rate accordingly.

Instead, properties are taxed at artificial and largely arbitrary effective rates fundamentally divorced from the actual value of real property in the city. This results in drastic and unjustifiable interclass and intra-class disparities in relative tax burdens that discriminate in practice on the basis of neighborhood, wealth, race, and political power.

Join our network to help make a change.